About GBP/USD

The US dollar is the most traded currency in the world. However, London is responsible for clearing more foreign exchange transactions than any other financial centre. Much like how the United States dominates the securities market, the UK dominates the foreign exchange market.

Many traders refer to GBP/USD by its nickname “The Cable”. The name originates from the transatlantic cable laid between the two countries to transmit exchange rates between the London Stock Exchange and the New York Stock Exchange.

The GBP/USD pair has a long and complicated history. Before World War 2, the British pound was worth more than five dollars. The currency pair has had its ups and downs in more recent history as each country went through recessions.

The British pound is the world’s longest surviving currency. The first pound coin was issued in 1489, and the first banknotes began circulating in 1694. At a point, the UK was the most powerful economy in the world, and therefore, so was the domestic currency.

The US dollar came to existence in 1792, shortly after the American Revolutionary War ended. Following a series of significant geopolitical shifts, such as WWII, the USD became the world’s leading currency.

GBP/USD CFD Specifications

When you trade GBP/USD, the base asset is pounds, and the quote asset is dollars. The contract size, often referred to as the Lot size is 100,000 pounds. The smallest order size that can be placed is 1,000 pounds, also referred to as a micro-Lot or 0.01 Lots. Orders can only be submitted in increments of 1,000, which means the second smallest order size that can be placed is 2,000.

GBP/USD is quoted with five digits. The fourth digit is known as the Pip, and the fifth digit is known as a Point. The value of a Pip depends on the size of the contract. If the contract is 1 Lot, the Pip value will be $10. If the contract size were 0.01 Lots, the Pip value would be $0.10.

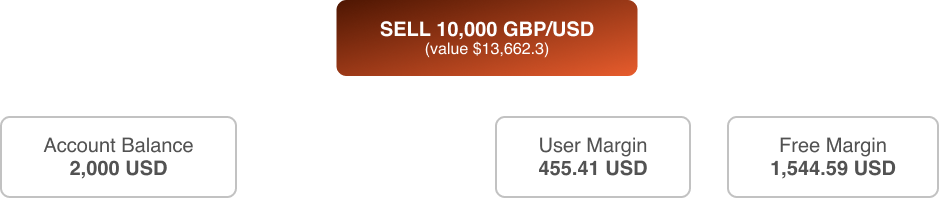

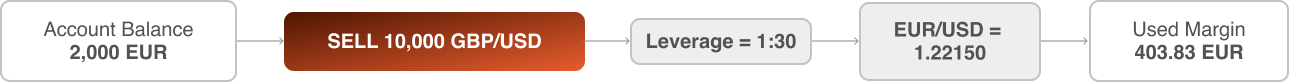

One of the benefits of CFD trading is you can trade with leverage, which reduces how much money needed to open a trade. ExpresslDigitalTrades offers up to 1:30 leverage for trading GBP/USD, which means you only need to provide 3.33% margin to open a position.

Why trade GBP/USD?

* Start Trading Now.

How a CFD Transaction Works

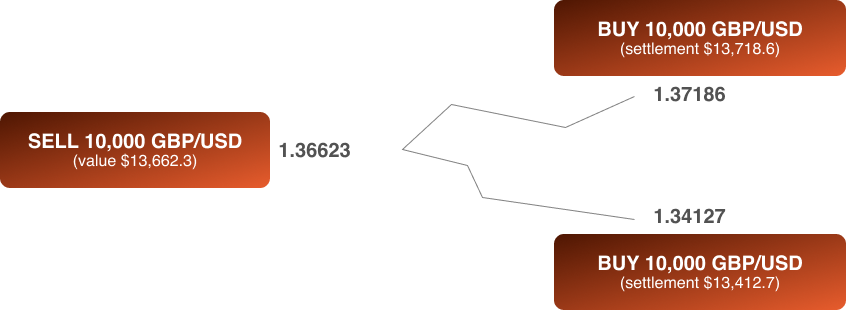

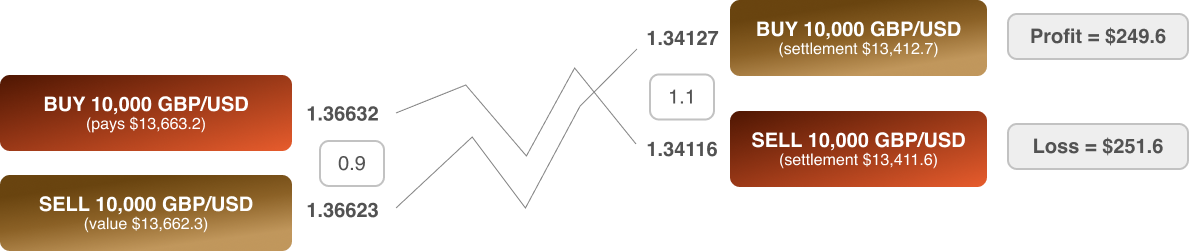

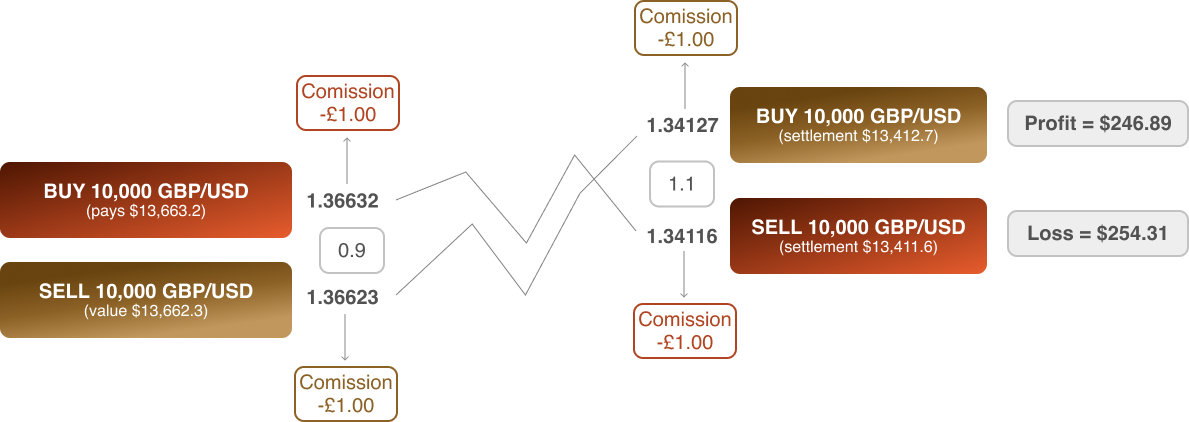

When you go short on GBP/USD, you’re theoretically selling pounds with dollars. When you close the trade, your profit or loss will be calculated in dollars. If the pound strengthened against the dollar, you’d get fewer dollars when you close the transaction. If the pound strengthened, you’d get back more dollars.

With leverage, you’re able to open larger positions than your capital would otherwise permit. When you trade forex CFDs with ExpresslDigitalTrades, you can use leverage as high as 1:30; meaning you only need to provide margin to cover 3.33% of the position’s value.

When you trade forex CFDs, you don’t need to own either of the currencies included in the pair. For example, if your trading account balance is denominated in British pounds, you can still trade GBP/USD. The purpose of a CFD is to enable traders to speculate on the price of one currency against another. When a CFD is closed, it will always be settled in cash, i.e. by increasing or decreasing the amount of balance in your trading account.

Costs To Trade GBP/USD

There are different costs involved when trading CFDs with ExpresslDigitalTrades. There are three primary factors which influence how much you pay for your transactions; they are:

The size of your trade, the bigger the trade, the higher the fees.

The instrument you’re trading, as different products have different characteristics.

The type of account you have, as different accounts have different conditions.

Costs Related To Trading CFDs

The different costs to be aware of when trading forex CFDs are spreads, commissions and swaps.

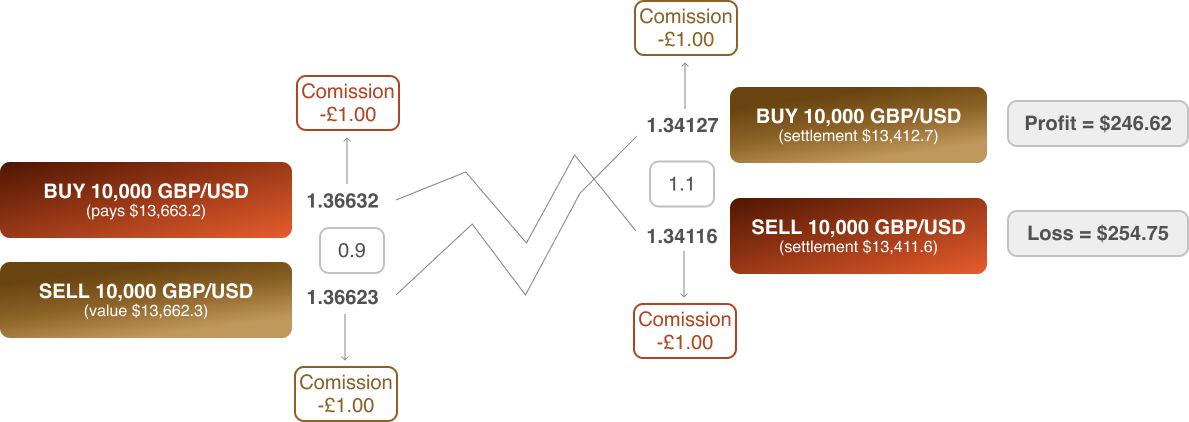

The spread is the difference between the bid and offer price. When you enter a long trade, your order is opened using the Ask-price, which is the higher of the two quotes. When the long trade is closed, the Bid-price, which is the lower of the two quotes.

Commissions are charged when you open and close a trade. In this example, the commission charged is £10 per Lot. Once adjusted according to the trade size of 0.1 Lots the commission becomes £1.00. When converted to dollars, it becomes approximately $1.35.

A swap is a fee for holding positions overnight. The price is derived from the base and quote currency’s interest rate differential and varies depending on whether your position is long or short. In this example, the swap rate for a long GBP/USD position is £3.19, and the rate for a short position is £2.00.