About USD/JPY

The USD/JPY currency pair is one of the most actively traded in the forex market. What makes this combination so interesting is neither the US nor Asian trading sessions overlap. Before China emerged as a global player, the United States, Japan and the Soviet Union were rivalling each other for the spot as the world’s leading economic powerhouse.

Before Japan emerged as a world leader, like many other currencies at the time, the Japanese yen was pegged to the US dollar. The fixed rate was 360 yen to 1 USD. Once the United States gold standard was abandoned, the yen floated freely and ultimately appreciated significantly against the US dollar.

Japan is one of the world’s largest exporters, and the demand for Japanese manufactured products sparks demand for the currency. However, the yen is also considered a safe-haven currency, which means it performs well during slumps. Since JPY is in demand when the economy is both performing and underperforming, it results in frequent short term trading opportunities.

USD/JPY CFD Specifications

The symbol for the Japanese yen in the forex market is JPY, and the symbol for US dollars is USD. Collectively, the pair is USD/JPY. Unlike most other trading instruments and dollar crosses, USD is not the quote asset in this currency pair. Since JPY has a much lower value than USD, it would be awkward to use dollars as the quote currency.

An unusual characteristic of USD/JPY is it’s quoted with just three numbers after the decimal point, whereas most other currency pairs are quoted with five digits. Therefore the Pip position is the second digit after the decimal, unlike most other forex pairs where it is the fourth digit after the decimal point. The value of a Pip depends on the size of the trade. If the order is for 1 Lot, the Pip value will be ¥1,000. If the contract size were 0.01 Lots, the Pip value would be ¥10.

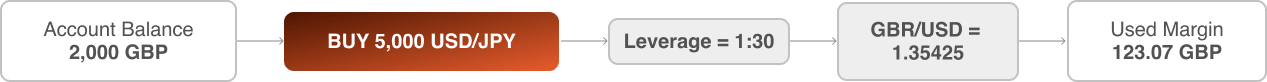

One of the benefits of CFD trading is you can apply leverage to your positions. This reduces how much money is required to open a trade. ExpresslDigitalTrades offers up to 1:30 leverage for trading USD/JPY, which means you only need to provide 3.33% margin to open a position.

Keep in mind that leverage is not free money that you should feel compelled to use and should only ever be used strategically since larger positions may lead to larger losses or profits.

Why trade USD/JPY CFDs?

* Start Trading Now.

How A CFD Transaction Works

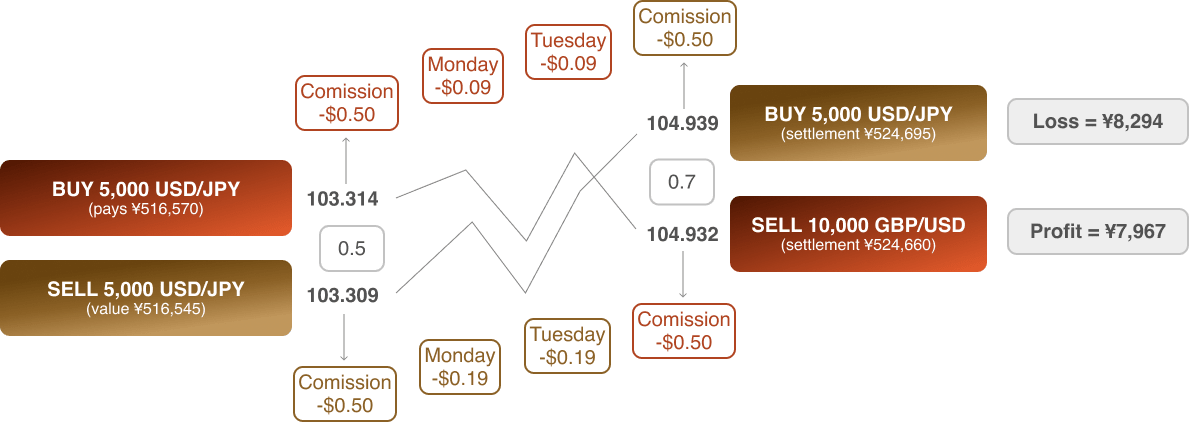

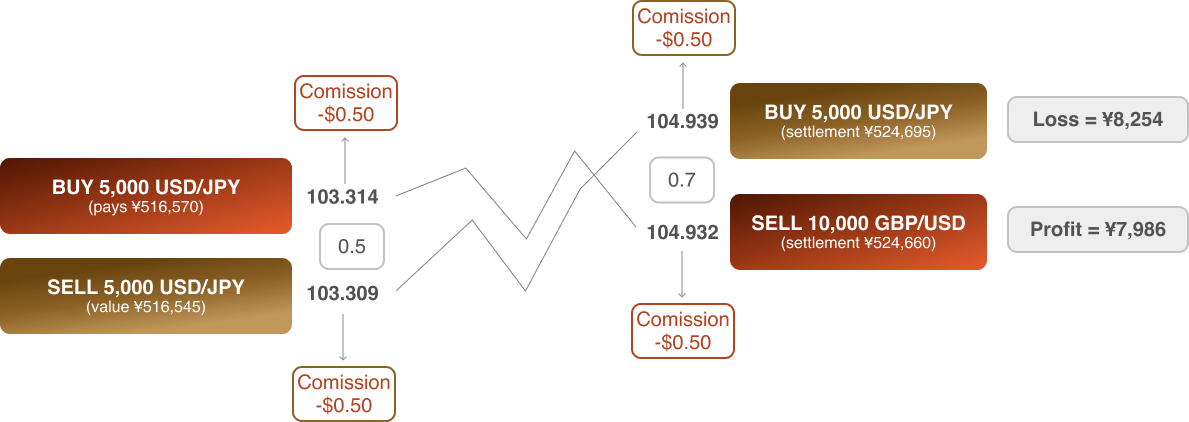

When you go long on USD/JPY, you’re theoretically buying dollars with yen. When you close the trade, it’s offset with another order in the opposite direction. The difference between the opening order and closing order determine the amount of profit or loss. Your profit or loss will be calculated in JPY. If the dollar strengthened against the yen, you’d get more yen when you close the transaction. If the dollar weakened, you’d get back fewer yen.

With leverage, you’re able to open larger positions than your capital would otherwise permit. When you trade forex CFDs with ExpresslDigitalTrades, you can use leverage as high as 1:30; meaning you only need to provide margin to cover 3.33% of the position’s value.

When you trade forex CFDs, you don’t need to own either of the currencies included in the pair. For example, if your trading account balance is denominated in British pounds, you can still trade USD/JPY. The purpose of a CFD is to let traders speculate on the price of one currency against another. When a CFD is closed, it will always be settled in cash, i.e. by increasing or decreasing the amount of balance in your trading account.

Costs To Trade USD/JPY

There are different costs involved when trading CFDs with ExpresslDigitalTrades. There are three primary factors which influence how much you pay for your transactions; they are:

The size of your trade, the bigger the trade, the higher the fees.

The instrument you’re trading, as different products have different characteristics.

The type of account you have, as different accounts have different conditions.

Costs Related To Trading CFDs

The different costs to be aware of when trading forex CFDs are spreads, commissions and swaps.

The spread is the difference between the bid and offer price. When you enter a long trade, your order is opened using the Ask-price, which is the higher of the two quotes. When the long trade is closed, the Bid-price, which is the lower of the two quotes. The opposite process takes place when opening and closing a short trade.

Commissions are charged when you open and close a trade. In this example, the commission charged is $10 per Lot. Once adjusted according to the trade size of 0.05 Lots the commission becomes $0.50.

A swap is a fee for holding positions overnight. The price is derived from the base and quote currency’s interest rate differential and varies depending on whether your position is long or short. In this example, the swap rate for a long USD/JPY position is $1.80, and the rate for a short position is $3.75. Swap rates fluctuate over time as banks adjust their interest rates.